Trade Smarter with Proven Algorithmic Trading

Access proprietary, research-driven trading strategies built for performance, risk control, and consistency — managed entirely by our team, powered by cutting-edge automation.

WHO WE ARE ?

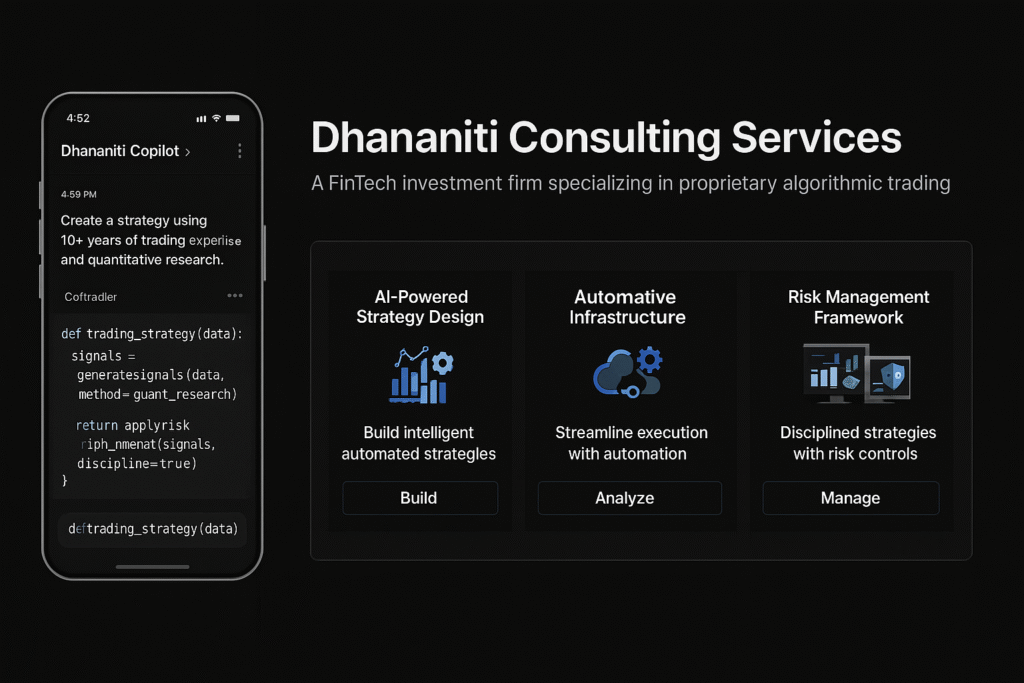

Dhananiti Consulting Services is a FinTech investment firm specializing in proprietary algorithmic trading. Our mission is simple — to help investors grow their capital through intelligent, data-driven strategies.

We combine:

- 10+ years of trading expertise

- Deep quantitative research

- Advanced automation infrastructure

- Disciplined risk management

Our goal is to deliver consistent, risk-adjusted returns without emotional decision-making.

WHAT WE OFFER

Algo Trading Software

Automate trading strategies to boost performance and returns.

Unified API Access

Connect to multiple trusted brokers via one powerful unified API.

Quantitative Strategy Development

Build and optimize rule-based trading strategies powered by data and research.

Tech-Driven Execution

Execute and scale your strategies with robust automation tools for traders and fintech builders.

OUR STRATEGIES

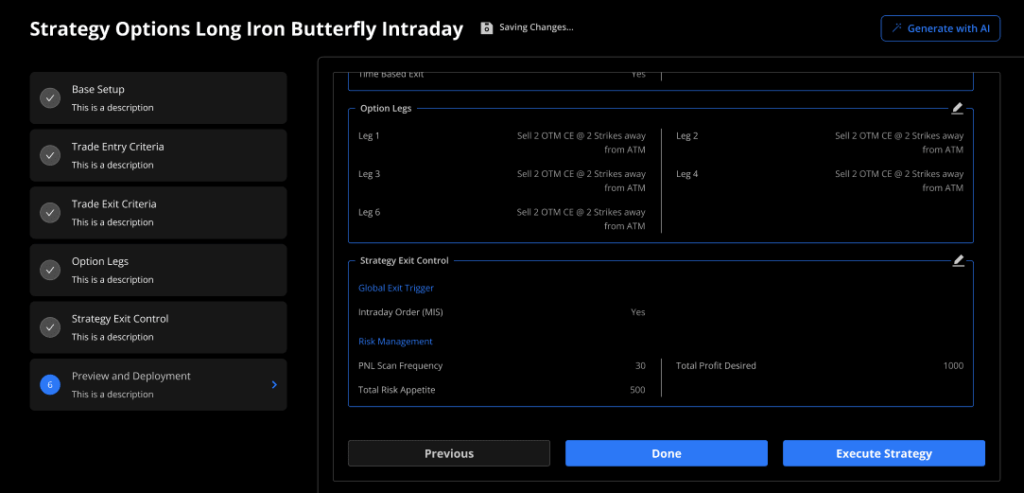

We offer a range of priority algo strategies designed for different market conditions:

Trend-Following

Capture strong profitable market moves.

Mean-Reverting

Profit easily from quick price corrections.

Market Neutral

Reduce risk by hedging market exposure.

All strategies are:

Back tested & forward tested

Continuously monitored and optimized

Built with strict risk controls

WHY CHOOSE DHANANITI

Performance-Driven

Every smart strategy is built to deliver consistent reliable returns.

Technology-Enabled

Proprietary advanced systems ensure precision and unmatched speed.

Hands-Free

No coding, no constant monitoring — we handle everything.

Transparency

Clear, detailed, transparent reporting and real-time, actionable, intelligent insights.

Scalable

Works for individual investors, family offices, and institutions.